The Downfall #3

How bad is it to be trading/investing without knowledge of risk management?

Imagine driving without understanding what traffic lights are for.

You may be lucky for awhile, you might even make some good return in the short term. But eventually car crash will happen, it is not even accident. If you choose to drive without learning what traffic lights are for, you are setting yourself up for disaster.

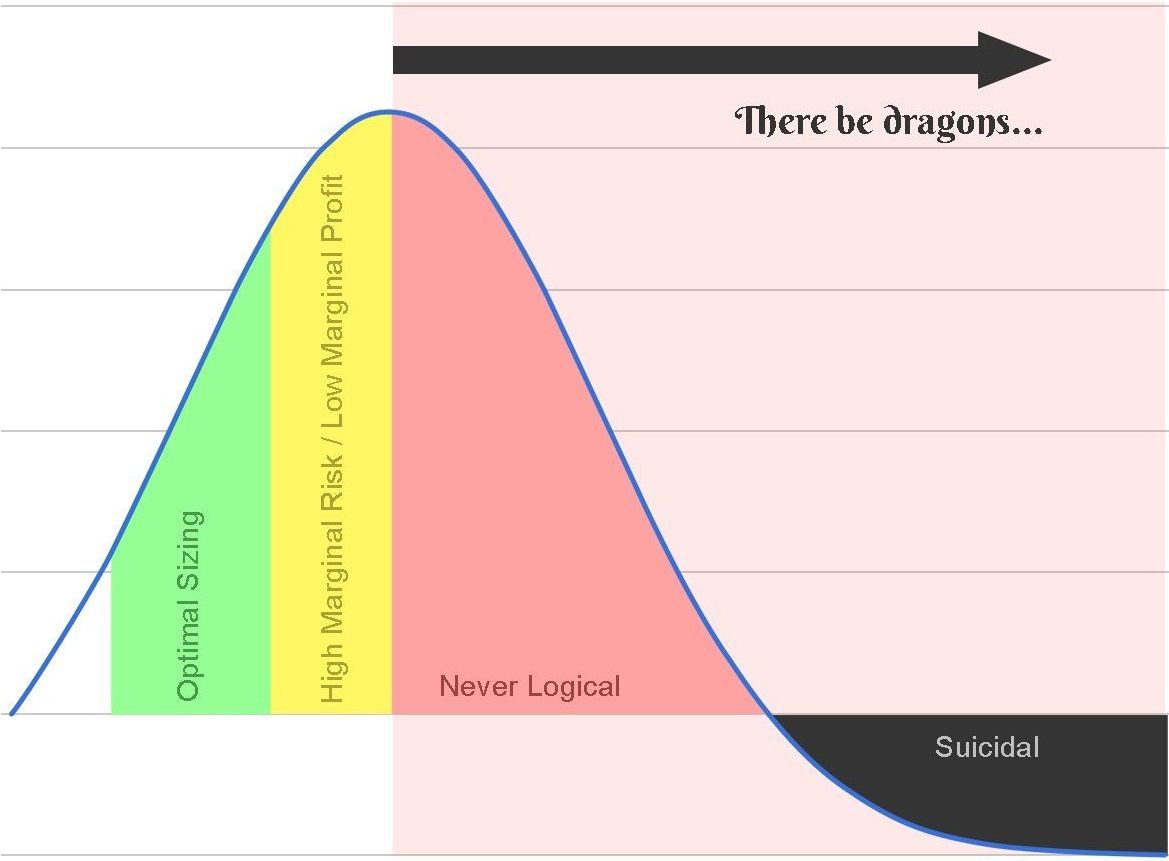

In the above picture is a curve displaying value/risk size.

White area is where you risk too low, it can be seen as an opportunity waste, green area is recommended risk size as it would gives decent return and drawdown level is less severe.

Yellow area above gives the highest value, but the average drawdown is also very high, often unacceptable, to a level many will consider a busted account.

Red area shown above is well labeled, it is never logical to risk that high. Why? because you could achieve the same value with lower risk, it's plain silly to risk more than the peak of curve, and the drawdown ahead would be huge. (crushingly huge)

Black area is congratulations. You have officially broke the game by turning something of positive expectation into negative expectation.

Let's say I have a strategy that gives me 60% win probability and 1:1 reward ratio. Now that i have a strategy with an edge, and i have $1000 for capital, how much should i risk in this trade? is 50% okay? this means that if i lose the trade i am left with $500 and $1500 if i win the trade.

I interviewed a few investor and asked them the above question, they mostly reply with "no idea" or "seems okay". Is it really okay? you can also take a moment to ask yourself what you think about it...

The answer: This risk size is in the suicidal area. The optimal size to risk is 20% of your capital each time which gives the highest expected value. 20%-40% risk is the "never logical area", anything above 40% is suicidal. Meaning you initially had positive EV, but because of your uneducated risk size, now it is negative EV.

So, it is totally not okay, the recommended risk size is somewhere between 5-10% or max at 20% if you have a higher risk appetite and is ready for heavy drawdown.