Kelly Criterion #1

When I talk to people whom are interested or involved in investing, I am amazed to discover how few really understands Kelly criterion.

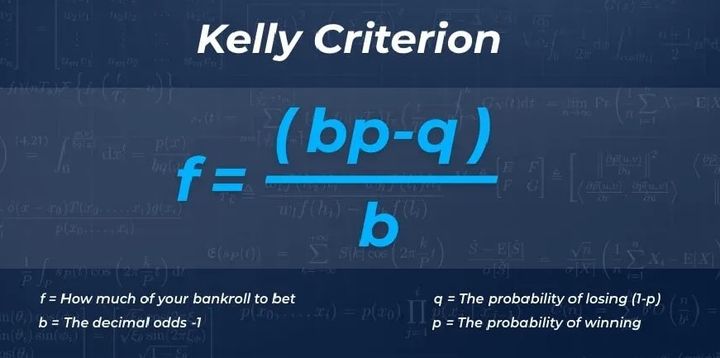

In my simplest words, Kelly criterion is used for finding how much you should risk. (This figure is always in percentage of your capital)

But you need something first.

Lets say you are trying to build a car, and you wants to know how much horse power you should built into it, you will need to know how much the car weigh, and how much it carries. Once you have the combined weight of car weight+carry weight, you can then use a formula to calculate how much horse power is optimal.

Your win probability and reward ratio is the car weight and carry weight. With these, you can then use Kelly criterion to calculate how much you should be risking.

For example, in previous post we talked about American Standard Roulette in https://understand-risk.ghost.io/when-to-take-risk/ you have 47.368% win probability, and 1:1 reward ratio (you risk a dollar for a dollar reward).

Using Kelly criterion formula, you will learn that the optimal risk amount is 0% of your capital (negative actually. it says that you should be the casino instead)

Yes you shouldn't risk at all because it has a negative expectation.

In another example where you have a positive expectation:

You have 60% win probability and 1:1 reward ratio, Kelly criterion formula will tell you that 20% is the optimal amount to risk. (if you have $10,000 in your capital, you should risk 20% of it which is $2,000)

Without having your win probability and reward ratio in place, there is no way to tell whether you have a positive expectation, or how much you should risk. Just like the car analogy, it is pointless to try and find the suitable amount of horse power, if in the first place you have no idea how much the car weighs and carries.